The Last Stage of Gold Bull Market: Mania

Every major gold bull market in modern history has exhibited the same three basic stages:

1. Currency Deflation Stage

2. Investment Demand Stage

3. Mania Stage

2. Investment Demand Stage

3. Mania Stage

The result:

A gradual, constant rise in gold prices at the beginning...

Followed by a sudden and dramatic spike towards the end.

Take a look at the 1970s gold bull market chart below, as an example of this phenomenon:

So far in today's gold bull market, we've seen the first two stages...

During the first stage of a gold bull market, gold prices go up because the value of the dollar goes down.

We've already experienced this very phenomenon over the last nine years — in the form of a 33% drop of the US Dollar Index between the summer of 2001 and spring of 2011.

Investors start to load up on gold, which further snowballs the price of higher still.

This is already happening.

With the introduction of the popular gold ETFs and other securities, investment demand has had incredible strength since the beginning of this gold bull market, growing in terms of both tonnage and dollar value.

And it continues to increase steadily...

Again, the first and second stages of a gold bull market generally return considerable gains.

Gold prices in this bull market, in fact, have increased as much as 449%.

But it's the third and final stage of a gold bull market that can turn everyday investors into instant millionaires.

Stage Three: MANIA

To see how something like this might look today, here's what the 1970s pattern I showed you up above looks like when applied to the modern gold market:

A sudden spike in demand, the beginning symptoms of which we're already starting to see today, could multiply gold prices by 100, 200, 300, as much as 400% from today's levels in the next 30 months.

And this isn't just me making these observations.

No matter where you look, experts in this field tend to agree...

Now, if you think that these predictions are shocking...

Or that the theory is controversial...

You couldn't be more wrong.

In fact, because it's always been a hedge against inflation, and a universally-accepted method of storing wealth...

Gold prices have followed one of the most predictable patterns known to economics.

So what happened in the 1970s, while dramatic, wasn't unusual or even surprising.

And it's exactly the same set of circumstances we're looking at today.

Devaluation of currency... increased investor demand...

Only this time around, there's one factor we have to consider that wasn't even on the horizon back during the last gold boom of 30 years ago.

And this factor is big and powerful enough to turn this into the biggest bull market in history.

China's Gold Fever

You hear about this raging economic powerhouse almost everyday in the news...

But what most people don't know is that despite all their cash, despite their vast manufacturing capacity...

The Chinese lack the single asset that they need to provide stability to their economy, confidence to their regime, and ultimately, achieve parity with the West.

They lack the single asset that governments have depended on for centuries to ride out recessions and cushion the effects of years of inflation on reserve currencies...

The Chinese lack gold.

Just look at this table to see what I mean:

World Official Gold Holdings: December 2009

Compared to the established Asian, European, and North American economies, China sorely lacks in the one area that may be most important to them in the coming years.

Looking closely at their foreign reserves, you'll see that they would have to multiply their gold holdings by a factor of 45 just to catch up to the United States.

And as you read this, that's exactly what they're doing.

China is working overtime to even out the gap separating them from the world's old-guard economic leaders.

And it's not just giant government-operated financial institutions that have flooded into this newly opened market...

The biggest single segment of buyers may prove to come from the emerging pool of China's private investors.

You see, Chinese families save between 30% and 40% of their annual earnings (on average).

That's up to eight times the rate at which their American counterparts save.

And yet — up until now — the Chinese domestic gold markets still lagged behind the United States and Europe by a factor of five.

But just like their respective banking institutions, these individual investors are rapidly closing the "gold gap."

Since last year, domestic demand for net gold investments in China has increased by121%.

According to UBS, the world's second largest manager of private wealth assets:

"The international gold market is now paying a lot more attention to China's gold demand, not just from an official reserve asset perspective, but also private demand..."

All this activity from two of the world's second biggest economy has contributed to recent rises in gold prices.

The real explosion in gold value, however, is yet to come... And mostly likely, it will be of a magnitude never seen before.

Just think about this:

If China's domestic gold consumption were to match U.S. levels, the world would have to produce an extra 12.4 million ounces of gold.

That's more than China itself — the world's single biggest producer — turns out in a year.

And considering that world gold production has dropped 8 out of the past 10 years, producing an extra 12 million ounces of gold per year to meet the demand will prove difficult, if not impossible.

Such a milestone would push prices higher than ever.

So, no matter who you listen to...

The conclusion is almost always the same:

It's highly unlikely that you'll be looking at a bull market like this one ever again in your lifetime.

will the history repeat itself?

better be prepare

will the history repeat itself?

better be prepare

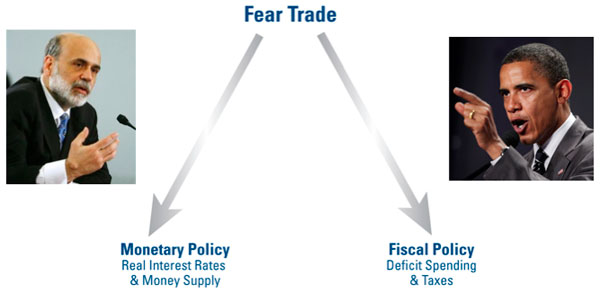

Investors who don’t think gold is a bubble but fear they’ve missed the boat need to look at the short- and long-term factors supporting gold at these historically high price levels. In the near-term, gold prices are being buoyed by continued weakness in the U.S. dollar.

Investors who don’t think gold is a bubble but fear they’ve missed the boat need to look at the short- and long-term factors supporting gold at these historically high price levels. In the near-term, gold prices are being buoyed by continued weakness in the U.S. dollar.