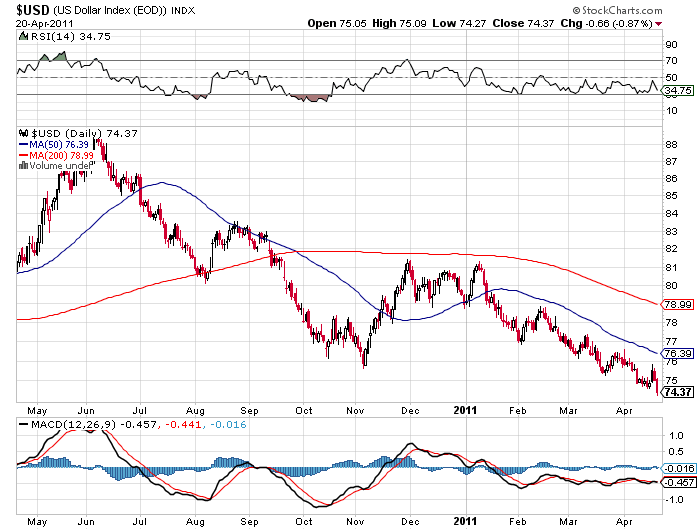

Economists at the ECB are now predicting “A Century of Inflation,” driven by loose US Monetary policy and rampant Dollar-printing. It’s time to concentrate on the fundamentals – Workers are not getting paid more and we can see no gain in the markets. We are living in a weak-dollar fantasy, partying like it’s Germany in early 1921 while the sane gold bug Speculators celebrate their wise investments as gold crosses 1,503 an ounce. The Dollar is down from 76 yesterday to 74.5 this morning, a stunning 2% drop for a currency in a country that didn’t have an earthquake or a revolution overnight. 75.63 was our low of last November (a one-day spike and we were back at 81 by the end of the month as the market fell apart) and before that we only touched 74.23 briefly in November of 2009 (it’s a bad month for the dollar). We flew up from there to 78 in December and 80 in January and have sunk rapidly since then.David Fry from ETF notes: “Monday’s S&P debt downgrade shocker is quickly old news and steamrolled by freshly minted cash (POMO) with ideas of more to come. Keeping money printing presses on high was a green light to sell the dollar which always causes commodities to rise. The Fed is also rumored to be selling, puts on Treasury bonds to keep rates low combined with maintaining the bogus inflationary “core rate”, to keep you mesmerized. It’s some Orwellian-speak to keep the masses happy even though the disconnect is seen at the pump and check-out counter.”

That disconnect sent gold over $1,503 per ounce and oil touched $112 a barrel this morning where, of course, we are shorting it (very tight stops).

The price of gold has already surged, surpassing an important barrier of $1,503 per ounce. Gold has been up every year since 2001 and has increased roughly 25% in the previous year, outshined only by another precious metal, Silver. Silver has reached a 31-year high by beating the $45 mark. In the last year alone, it has raced ahead by almost 150%. President Ron Fricke of Regal Assets is now referring to silver as gold on steroids. The question is: can the precious metals keep up this pace?

The logical answer lies in why their prices are surging in the first place. Investors may be divided on this issue. Some argue that the soaring prices of precious metals are driven by market speculators. That it’s just another bubble waiting to burst, much like the housing bubble in the US in 2007. Other investors believe the rise in gold and silver is not the result of crazy speculation; rather, they feel that the rise is connected with the economic fundamentals of modern economies. One important thing to remember is that the prices of gold and silver are not related to industrial demand. The price of copper, for instance, has gone down over fears that the economic recovery might stall. Gold and silver, on the other hand, flourish on news of problems in the economy. Precious metals have been driven up by fears of crumbling economic activity and creeping inflation. As we saw earlier, the price of both gold and silver skyrocketed after S&P changed the outlook of US debt from stable to negative. Lowering the US credit rating will make borrowing for the US government much more difficult and expensive, leading to a weaker dollar—its yo-yoing will keep gold and silver in tact for long time.

The precious metals have also been propelled by problems in another major paper currency – the Euro. Eurozone’s two-speed economy – with the recovery gaining firm ground in countries like Germany and France, while debt-ridden economies of Eurozone’s periphery remain very close to declaring bankruptcy – raises fears over long-term sustainability of the Euro project. Such prospects are likely scaring some investors away from the Euro. When things get rough, investors want to invest in something more tangible than stocks or paper currencies, which are ultimately just pieces of paper.

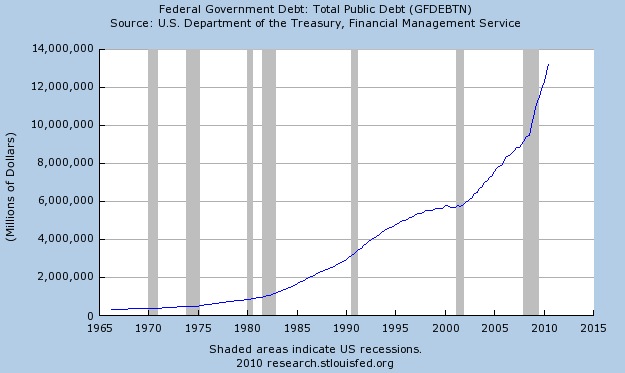

Precious metals should be viewed as just another form of currency. The major difference between the dollar and gold/silver is that the latter relies on mining. In general, the increase in the supply of precious metals is a single-digit number on a yearly basis. On the other hand, the supply of dollars is controlled by the Fed, which has the power to increase its supply by a much larger amount. This is exactly what the Fed has been doing with the program of quantitative easing, prompting many analysts to comment on the liquidity flood of biblical proportions. A strong rise in the supply of major paper currencies also contributed to their fall in value in comparison to gold and silver.

So, how far gold and silver can go ultimately? It depends on economic fundamentals and the shrinking value of the dollar. “For the dollar, the S&P statement earlier this week revising its long-term outlook for U.S. debt from stable to negative,) was like getting kicked when you’re already down,” said Matt Zeman, a senior market strategist at Kingsview Financial in Chicago. “The dollar is losing its status as the king of the hill, and gold is looking to take its place.”

While Gold reached a record $1,506.03 an ounce, the Treasury Department has projected that the government will reach the $14.3 trillion debt-ceiling limit no later than May 16 and run out of options for avoiding default by early July. “As the numbers show, the debt cannot be repaid without dollar debasement, so there is the reason people are warming up to the idea of hoarding gold,” Zeman said.

Source: http://goldcoinblogger.com/inflation-guaranteed-as-silver-and-gold-climbs/#more-2967

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.