THE US FEDERAL RESERVE, America's central bank, is printing money to purposely create inflation, writes Dr. Steve Sjuggerud in his Daily Wealth email.

Meanwhile in Europe, the central bank is doing the opposite. It's taking actions to prevent inflation from ever appearing.

So who is doing the right thing?

The problem is essentially the same in America and in Europe. Why – when faced with the same problem – are the US and Europe pursuing opposite solutions?

I think I have the answer...

Each central bank is trying to prevent a repeat of its worst mistake in history. Let me explain...

The Great Depression was the worst economic crisis in American history. The big issue in the Great Depression was DEFLATION – falling prices. The US central bank is typically given the blame for the Depression, for not fighting deflation hard enough – for not printing enough money.

Ben Bernanke, the head of our central bank, has made it his life's mission to prevent a repeat of the Great Depression. Bernanke is a student of the Depression. He will do everything in his power to prevent falling prices from happening.

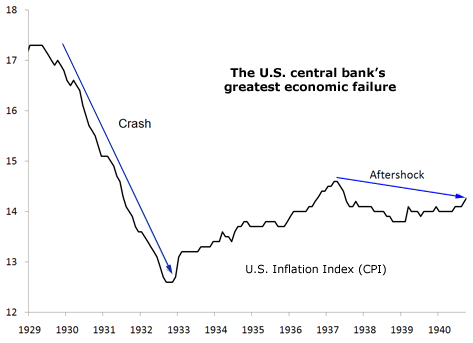

Bernanke won't stop once inflation appears... because he knows a deflation "aftershock" could hit. Inflation started to rise again in the mid-1930s... then a deflation "aftershock" hit. The chart shows the story:

Bernanke believes this was the worst policy failure by the US central bank. He won't let it happen again. So expect inflation to arrive at some point. And expect it to stay, to ward off a potential deflation aftershock.

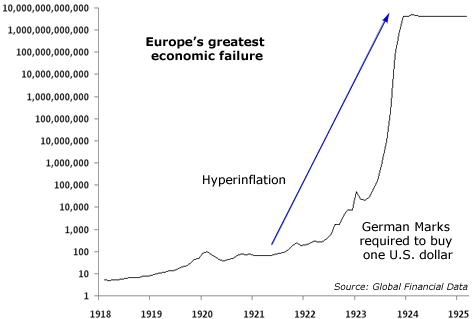

The European Central Bank (the ECB) is also well aware of its greatest economic failure of all time. That was hyperinflation in the early 1920s.

Inflation in Europe just hit 2.6%, above the ECB's acceptable rate of 2%. So last week, the ECB raised interest rates. The goal was to contain inflation.

While Europe is raising interest rates to slow the risk of inflation, the US is expected to keep interest rates where they are for the foreseeable future. The US is also continuing its "quantitative easing program" which is essentially printing money, by another name.

So what can you do with this knowledge?

If Bernanke won't stop, you can expect more of the same... higher commodities prices (particularly gold and silver) and a lower value for the US Dollar and US government bonds.

This conclusion isn't shocking... What is shocking is just how far these trends will go if Bernanke keeps his promise to prevent deflation.

In short, in the US, asset prices could soar higher and the Dollar and government bonds could fall lower than most anyone can imagine.

Source: http://goldnews.bullionvault.com/US_printingmoney_041220112

No comments:

Post a Comment